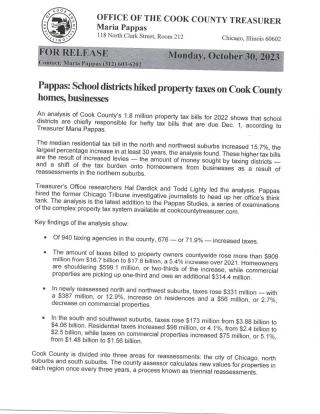

Pappas: School districts hiked property taxes on Cook County homes, businesses

Pappas: School districts hiked property taxes on Cook County homes, businesses

An analysis of Cook County’s 1.8 million property tax bills for 2022 shows that school districts are chiefly responsible for hefty tax bills that are due Dec. 1, according to Treasurer Maria Pappas.

The median residential tax bill in the north and northwest suburbs increased 15.7%, the largest percentage increase in at least 30 years, the analysis found. These higher tax bills are the result of increased levies — the amount of money sought by taxing districts — and a shift of the tax burden onto homeowners from businesses as a result of reassessments in the northern suburbs.

*Read further on attachments or click the link https://cookcountytreasurer.com/pdfs/taxbillanalysisandstatistics/taxyea...

| Attachment | Size |

|---|---|

| 474.64 KB |